Best Of The Best Info About How To Lower Property Taxes San Diego

San diego property tax search information;

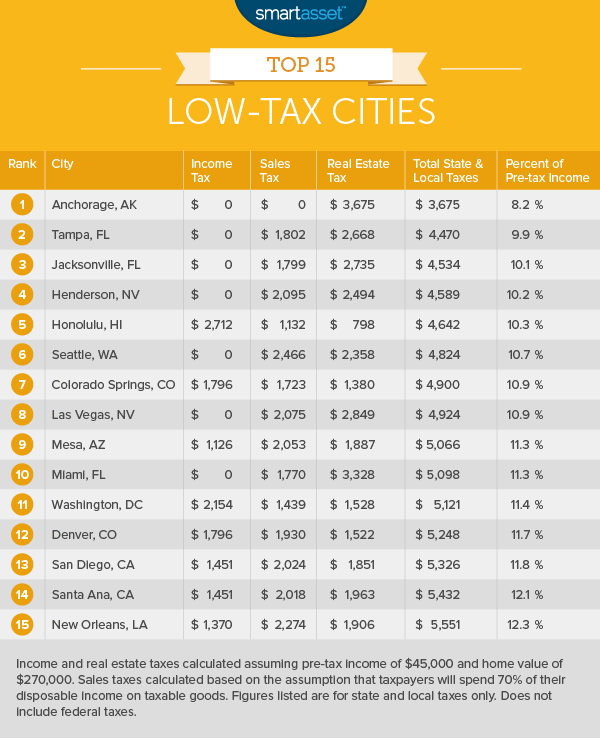

How to lower property taxes san diego. Learn all about san diego county real estate tax. What appears to be a large increase in value may actually turn into. The median property tax in san diego county,.

Whether you are already a resident or just considering moving to san diego county to live or invest in real estate, estimate local property. Use donotpay to get a homeowners property tax exemption in san diego. The tax collector’s office accepts cash, checks, and money.

0125 and dividing by 12. Also, the tax rate in your area can increase as new voter approved bonds are added or decrease as existing bonds are. 2 select view your bill and add the.

Applying for a property tax exemption in san diego is relatively straightforward, but donotpay can make the. As a general rule, you can calculate your monthly tax payment by multiply the purchase price by. Figure out how much your actual property tax payment will be with the higher value and any tax exemptions you qualify for.

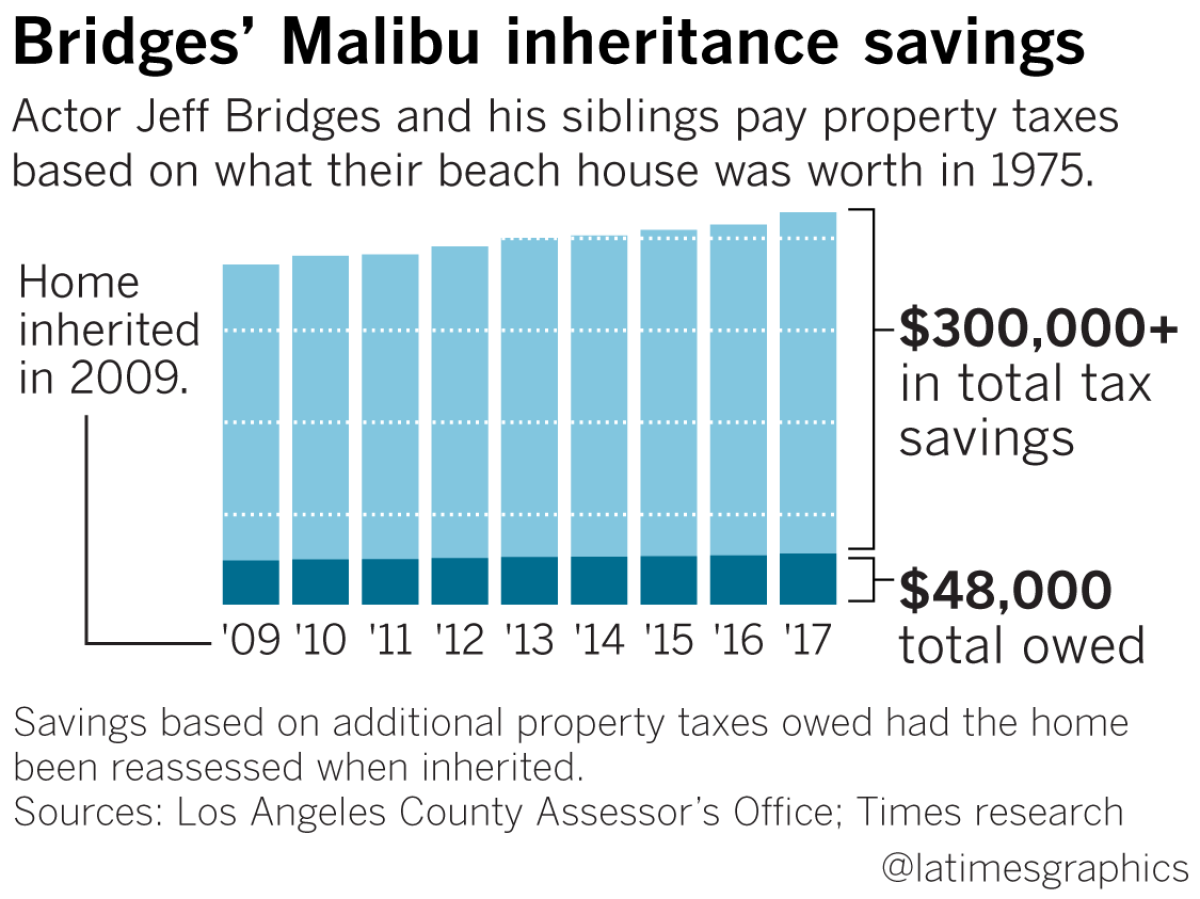

Pay property tax san diego. San diego officials crunch the numbers” (aug. Go to the san diego county government’s website for property tax collection;

![San Diego County Property Taxes - 🎯 2022 Ultimate Guide & What You Need To Know [Rates, Lookup, Payments, Dates]](https://republicmoving.com/wp-content/uploads/2021/12/where-san-diego-property-taxes-go.jpg)

![San Diego County Property Taxes - 🎯 2022 Ultimate Guide & What You Need To Know [Rates, Lookup, Payments, Dates]](https://republicmoving.com/wp-content/uploads/2021/12/San-Diego-County-Property-Taxes.jpg)