Cool Tips About How To Become An Enrolled Agent

You can take and pass the online exam, or you can work for the irs.

How to become an enrolled agent. Ad leaders in enrolled agent exam review, irs afsp, tax & ea cpe. See why we are trusted by the largest tax firms in the world. You will need to achieve a passing score on all three parts of the exam to become an enrolled agent.

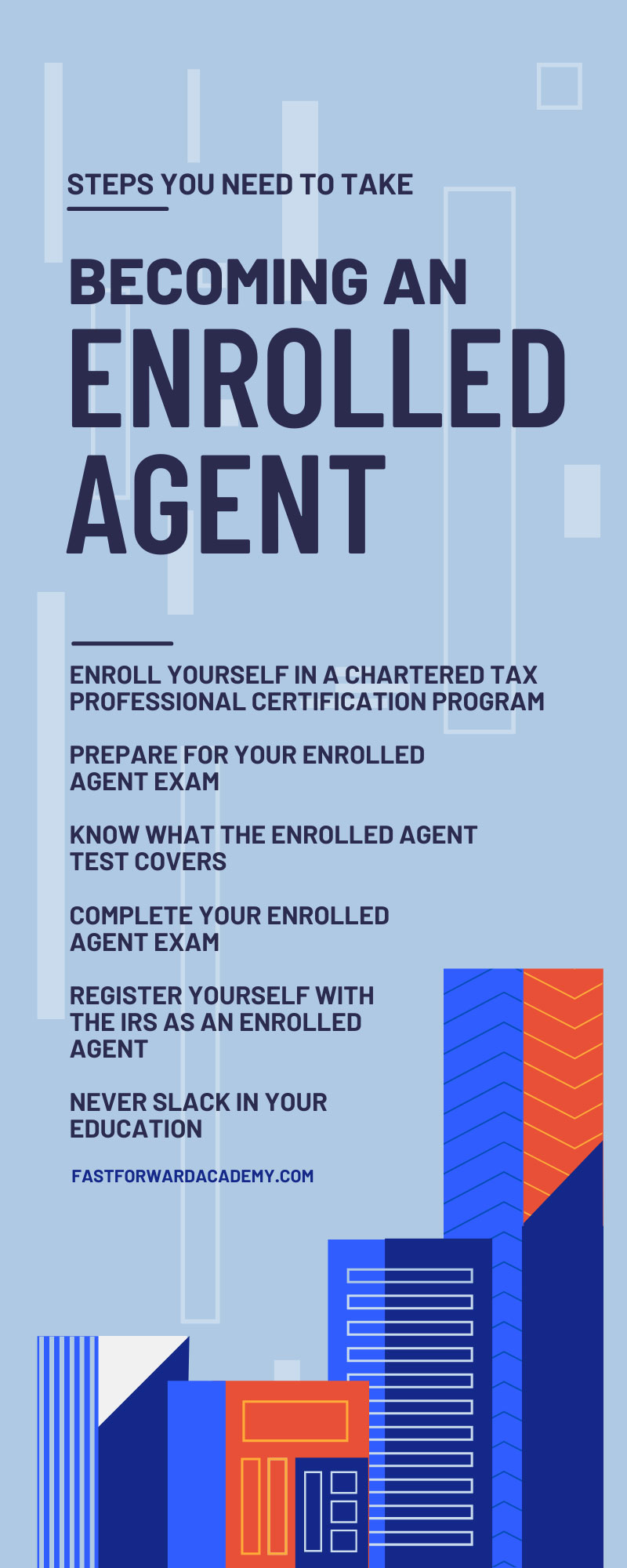

Enroll in become an ea. The irs lists three steps to becoming an enrolled agent: This is part of the hours of continuing education.

Steps to become an enrolled agent there are three routes to attaining, or maintaining, your ea licensure: Prepare for the ea exam to become an enrolled agent with our ea review course that will give you the confidence needed in obtaining the tax knowledge to prepare individual tax returns. Because this is a federal licensing program, the.

Enrolled agents have demonstrated competence in tax matters, allowing them to represent taxpayers before the internal revenue service. Have past service and technical experience. To become an enrolled agent, most people take and pass the ea exam, also known.

Obtain a ptin through the irs. A minimum of 16 hours must be earned per year, two of which must be on ethics. The irs offers 2 paths to earning the ea designation:

A minimum of 16 hours must be earned per year, two of which must be on ethics. Generally, enrolled agents must obtain a minimum of 72 hours per enrollment cycle (every three years). Candidates can then apply for enrollment.

Become an enrolled agent, the highest credential the irs awards, and find out how to maintain your status. An enrolled agent is a person who has earned the privilege of representing taxpayers before the internal revenue. Become an enrolled agent apply to become an enrolled agent, renew.

We've determined that 47.6% of enrolled agents. Generally, enrolled agents must obtain a minimum of 72 hours per enrollment cycle (every three years). If you're interested in becoming an enrolled agent, one of the first things to consider is how much education you need.

Testing, experience, or fees and cpe. Apply for enrollment once you’ve passed all. The irs issues ptins on a.

The first step to becoming an enrolled agent is to obtain a ptin. If you already have a ptin, you’ll need to make sure it’s current, and if isn’t, you’ll have to renew it. The federal government requires passing a comprehensive examination or having 5 years work experience with the irs to become a licensed enrolled agent.

![Enrolled Agent Exam [2021] | 500+ Questions](https://www.test-guide.com/images/Enrolled_Agent_Exam_Article.png)