Peerless Tips About How To Build Up My Credit

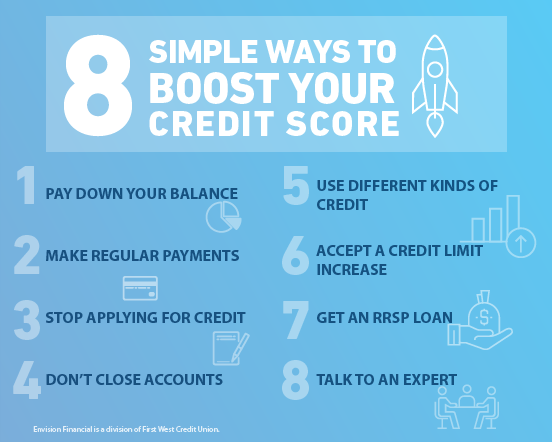

Pay your bills on time — every time.

How to build up my credit. There are many ways to use a credit card to build credit. Improve your fico® score & get credit for the bills you're already paying. The portion of your credit limits you're using at any given time is called.

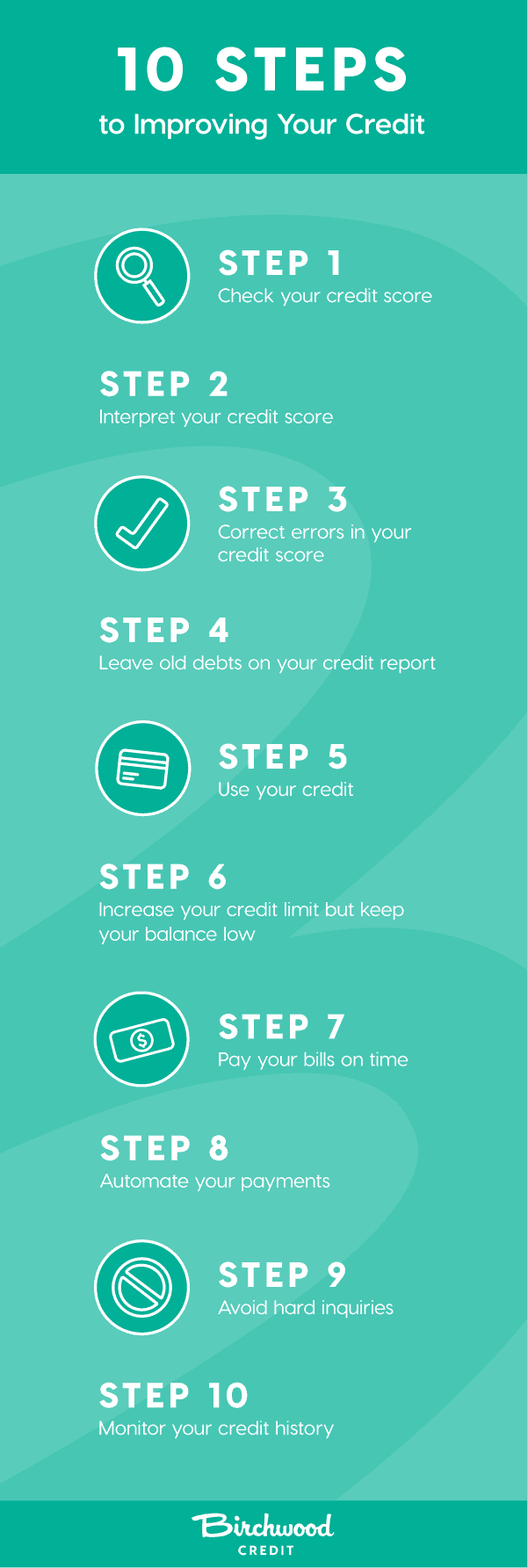

You’ve managed your bank account responsibly, paid all your bills on time every month and used a credit builder card to build up. However, building a credit score is about responsible credit usage and positively impacting the. Credit cards offer one of the best ways for you to build your credit and improve your credit scores by showing how you manage credit on a regular basis.

Ad responsible card use may help you build up fair or average credit. The average interest rate is 16.17% (based on. Building credit takes a lot of effort.

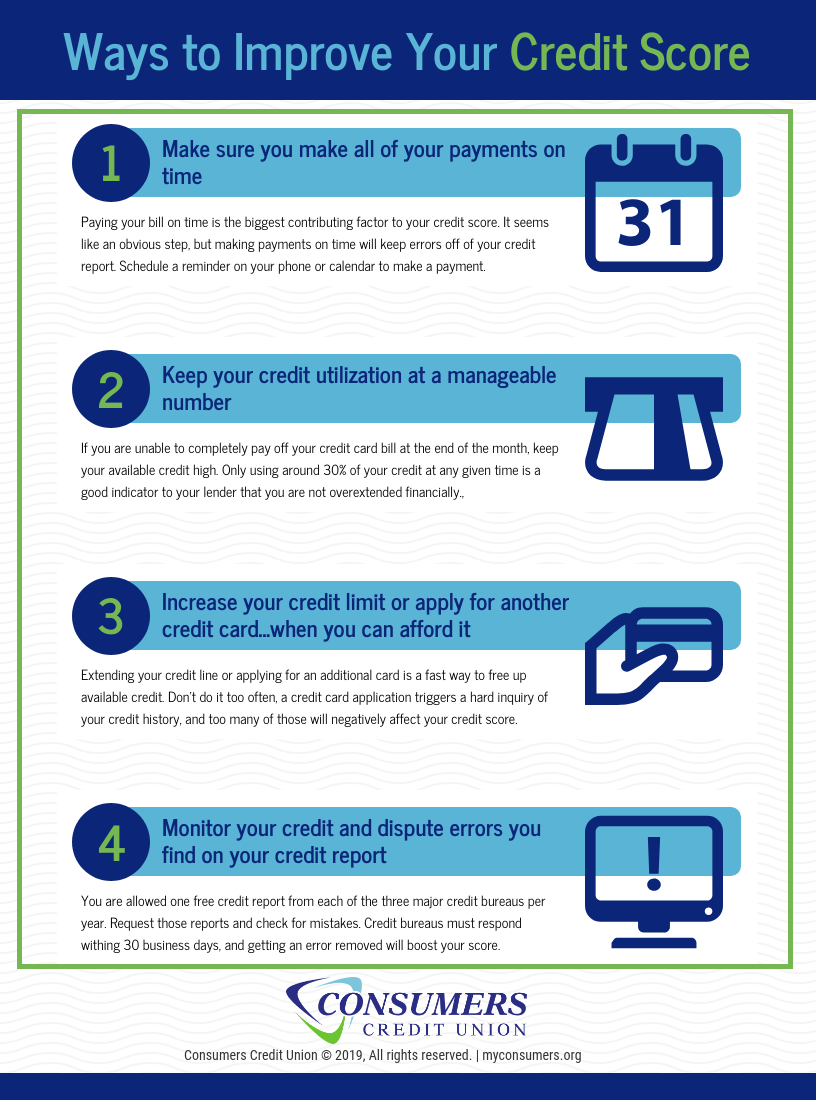

Simply using your card for purchases won't help build or rebuild your credit. But there are also general steps that can help almost anyone's credit. “making payments on time and keeping your balances low are the two most important factors when it comes to building credit,” griffin says.

Apply for a better credit card. You can use your credit card to make purchases, and they are very convenient. Ad 2021's best credit repair companies.

Paying your rent and utility bills on time is the #1 step when it comes to how to improve your credit score. Ask for higher credit limits. Alternative data refers to information that traditionally hasn’t been widely found on credit reports, such as your history of making.

A credit card may be a good way to start building credit. Instead of giving you the loan, the bank holds the money until you pay off the loan with regular payments. Instead, building and rebuilding is about using your card responsibly over time to help improve your.

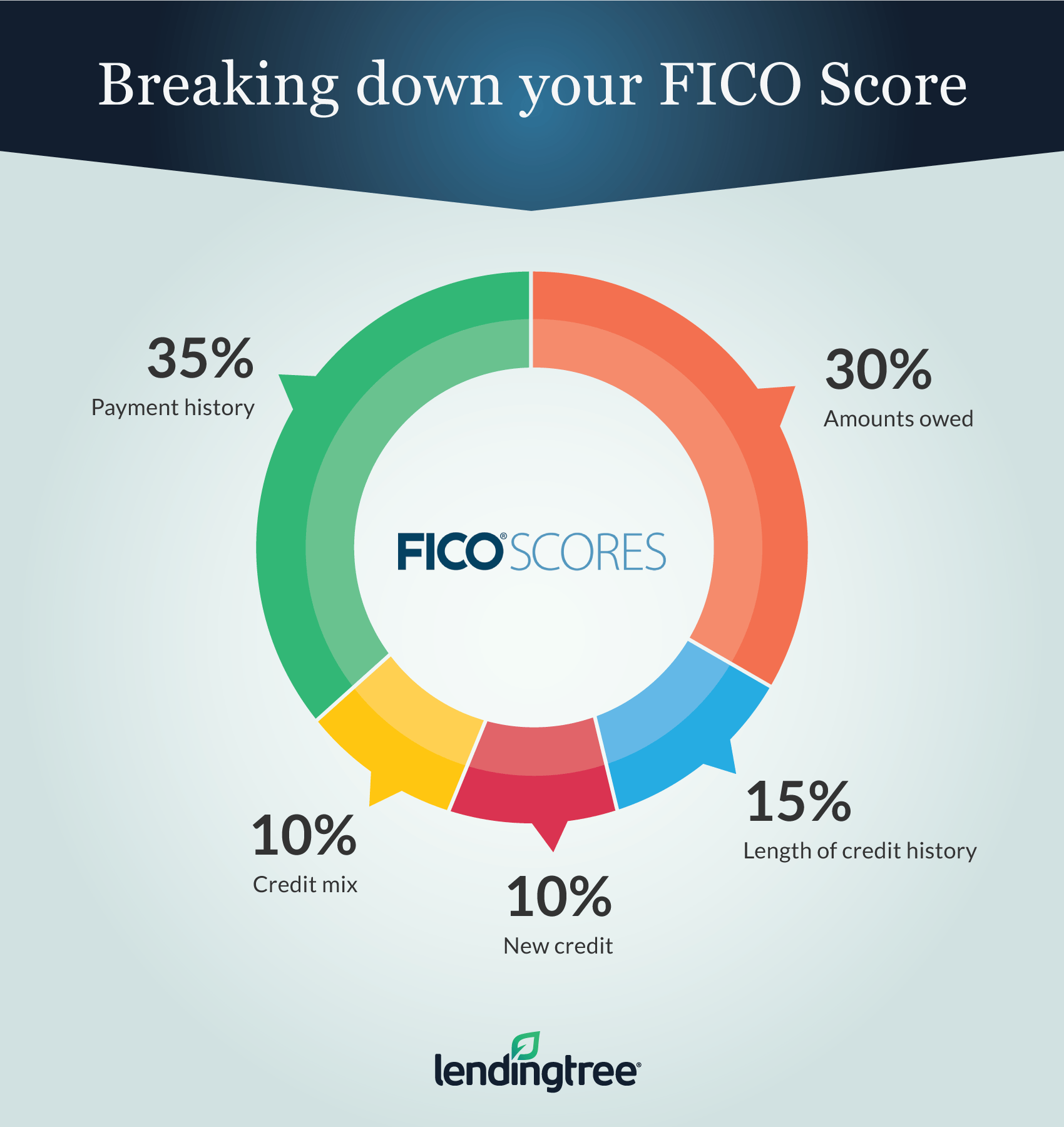

How to start a credit score, best ways to build credit, how to build my credit score, credit building credit cards, how to improve credit score, how to build credit with no credit, how to build your. Your score is affected by five factors: Ad see score factors that show what’s positively or negatively impacting your credit score.

Pay credit card balances strategically. For others, it could take six months to a year. Your credit utilization rate, which is the amount of credit you use out of your.

You’ll want to start by accessing your credit report and making sure that you already have all eligible accounts on there. Opening new accounts that will be reported to the major credit bureaus—most major lenders. Build up your credit, free ways to build credit, 3 ways to build credit, other ways to build credit, 10 ways to build credit, how to build up credit, how to build your credit, top ways to build credit.