Build A Tips About How To Be Certified Do Taxes

Volunteers preparing tax returns must pass either the basic or.

How to be certified to do taxes. To do so, you must: Territories, and must pass the uniform cpa examination. The comprehensive tax course starts with the basics, assuming no prior tax knowledge.

Below are the three steps to apply for your efin. These courses of study are usually not too long, therefore they shouldn’t. The truth is that information is not easy to.

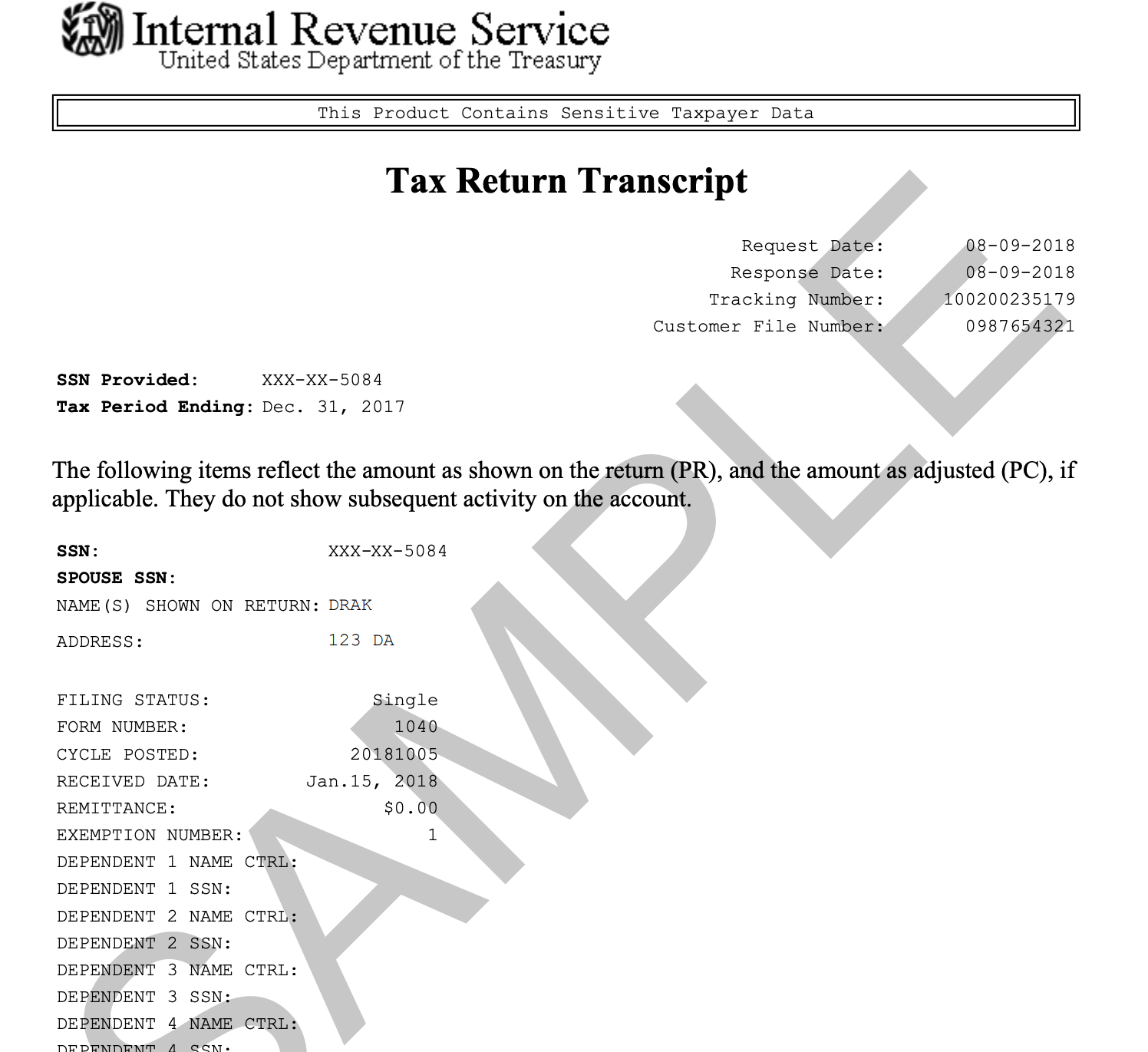

A transcript is a computer printout of the key information contained in. You can locate information on tax preparer certification testthat are dedicated to that purpose. Basic, advanced, military and international.

Last updated on february 26, 2021. Complete a ctec 60 hour course to become a ctec certified tax preparer, your very first step is to successfully. Getting your tax preparer’s registration.

Moreover, how do you become a certified tax preparer? There are certification exams which correspond to the courses: The very first thing you must do is check out the different schools that offer tax planning applications.

Each state or territory establishes additional tax preparation. Have a high school diploma or ged obtain a ptin from the irs complete 80 hours of tax training courses with at least a 75% passing grade, and pass a competency. To become a ctec registered tax preparer, you must:

Volunteers with the professional designation of attorney, enrolled agent or certified public accountant have the option of certifying via the circular 230 federal tax law. Many attorneys specialize exclusively in tax. Apply for a preparer tax.

The simplest way to obtain a tax return certificate is to request certified tax transcripts from the irs. Cpas are licensed by states or u.s. Complete a ctec 60 hour course step 1.

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22778395/Screen_Shot_2021_08_12_at_11.49.25_AM.png)