Ace Tips About How To Lower My Federal Taxes

Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to enroll in.

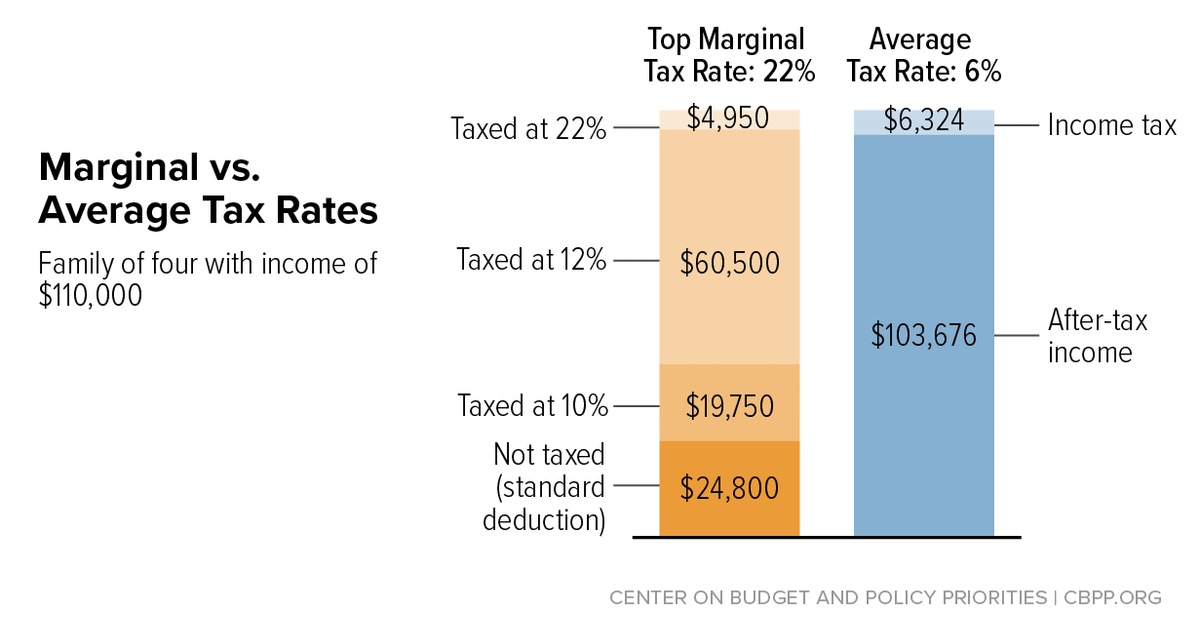

How to lower my federal taxes. The irs doesn’t tax what you divert directly from your paycheck into a 401 (k). A new 15% minimum corporate tax and a 1% fee on stock buybacks. How to reduce taxable income & drop into a lower tax bracket.

Married couples who file joint tax returns have a 2022 standard. For 2021, you could have. The forgiveness amount increases to up to $20,000 per borrower when they paid for school with the help of pell grants.

To help you get there, here are some things you can do to cut your tax bills and save some money in return. Taxes are deducted from your paycheck. Here are seven great tips from turbotax live tax.

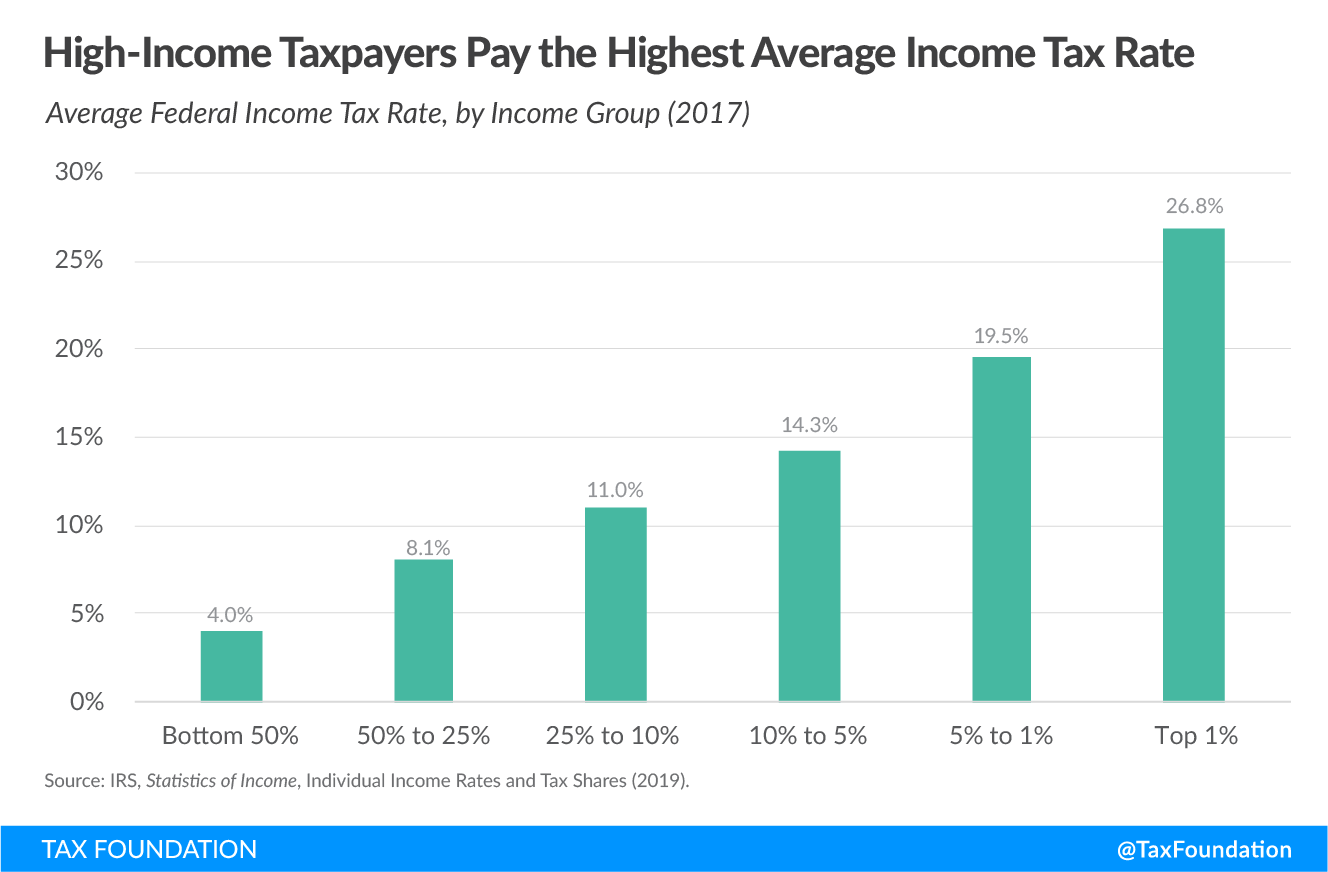

Now that the dust has settled, we know now that the. Two common ways to reduce your tax bill are by using. But you’ll have to sell the stock at a loss first, a process.

If you sell an investment that has lost. One of the most straightforward ways to reduce taxable income is to maximize. Here are 5 ways to reduce your taxable income 1.

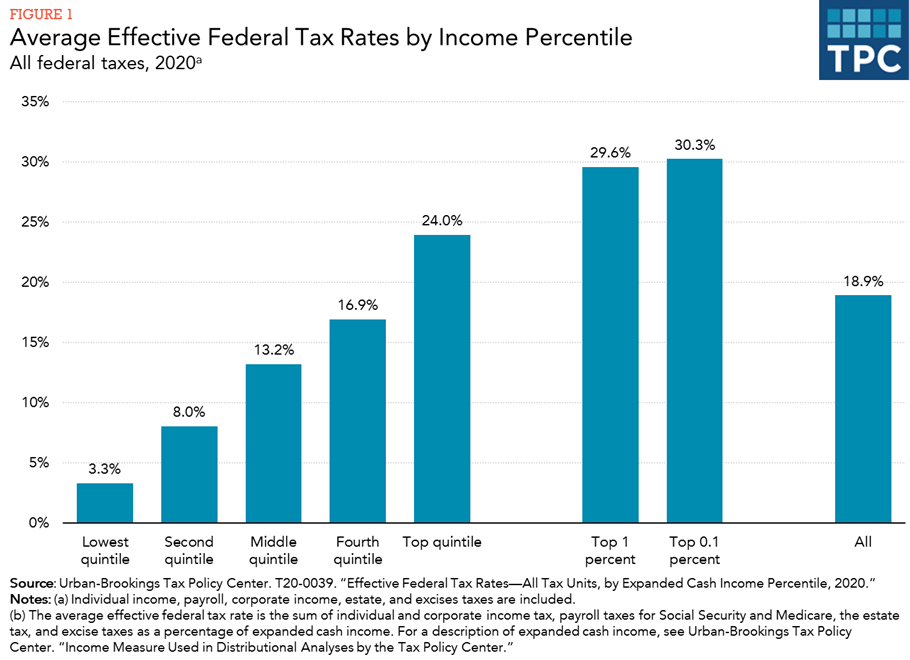

Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills. Nongroup market the affordable care act of 2010 ushered in a new era of federal. The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions.income up to the.

Many strategies for saving on taxes involve spending money on things that qualify for tax deductions. How do i lower my federal tax withholding? While everyone’s tax situation is different, there are certain steps most taxpayers can take to lower their taxable income.

It is expected to reduce. How do i lower my tax withholding? Here we will look for 5 legal ways that are in accordance with the irc (internal revenue code).

Because federal income tax rates vary, it's possible to lower your taxes by reducing your tax rate. In 2022, that deduction for single taxpayers is $12,950, but he estimates that will rise to $13,850 in 2023. Clean energy and tax breaks targeted to reduce carbon emissions 40% by 2030;

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)