Best Of The Best Info About How To Keep Track Of Business Miles

But keeping records of that travel—consistent, accurate, and tidy ones, at.

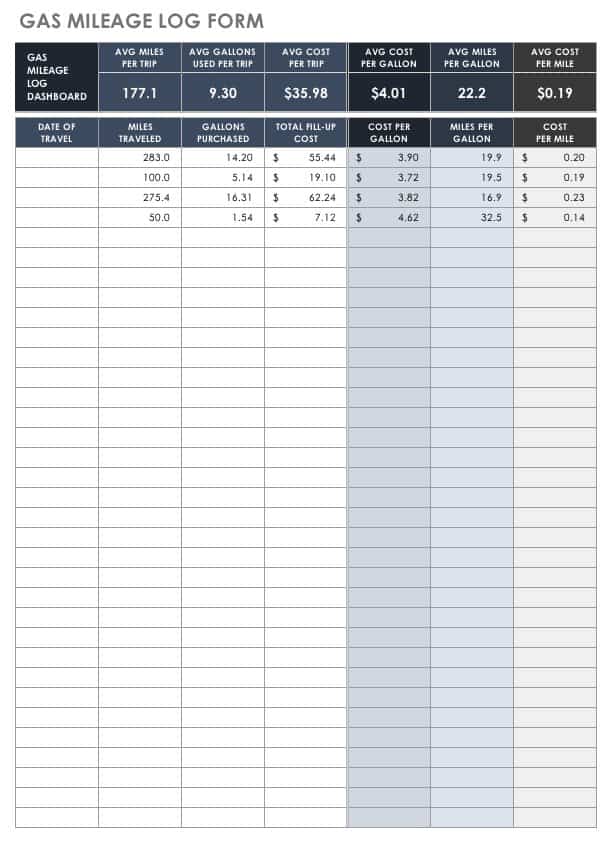

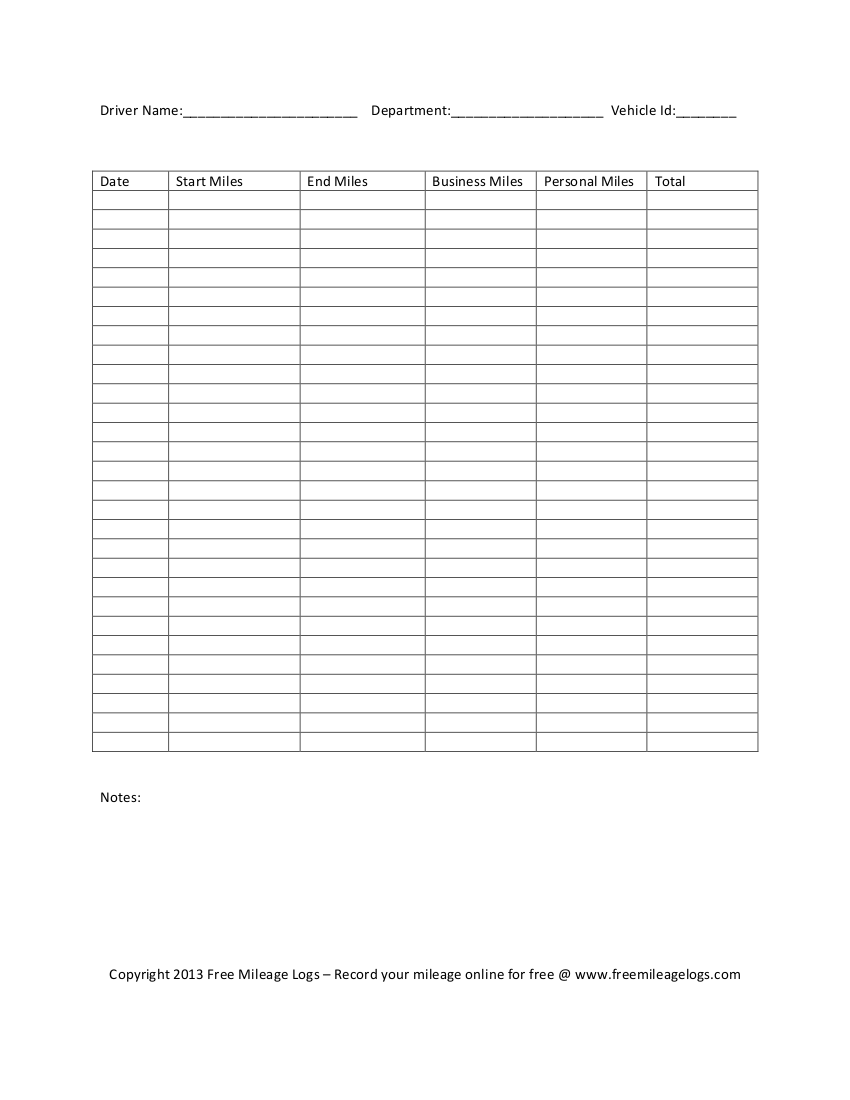

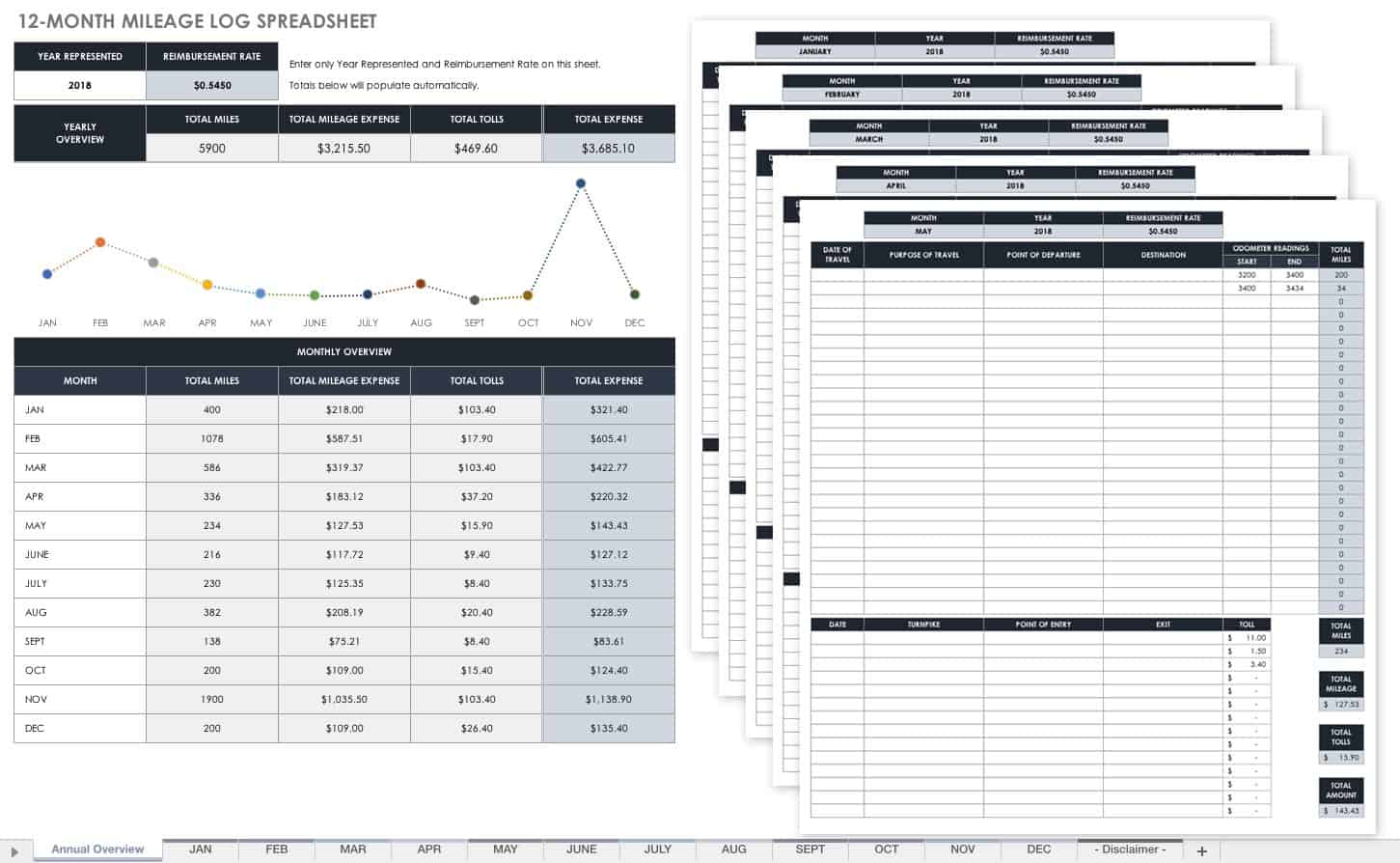

How to keep track of business miles. If you plan on writing. Decide how to log your miles if you do everything electronically, you may want to log your miles on a spreadsheet. Keep track of all vehicles in your business in real time.

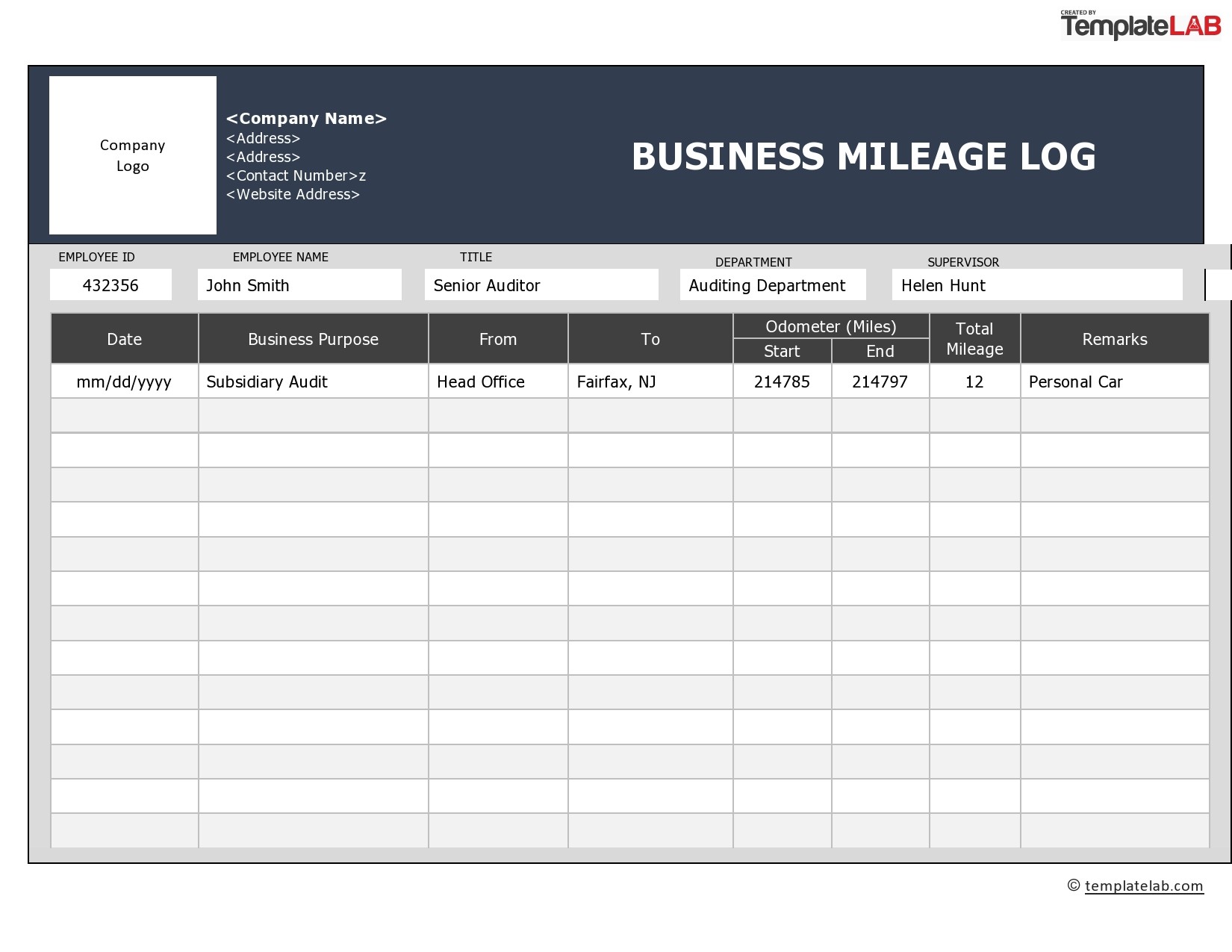

Keep a detailed mileage log. Fill in our form to easily track your fleet in 2022! Tracking your miles with a mileage log keeping thorough records will help you document your business expenses.

It can be a pain to record your business miles. Here are the key steps to help you track your mileage. Use these mileage tracker templates to measure your mileage and keep accurate mileage records.

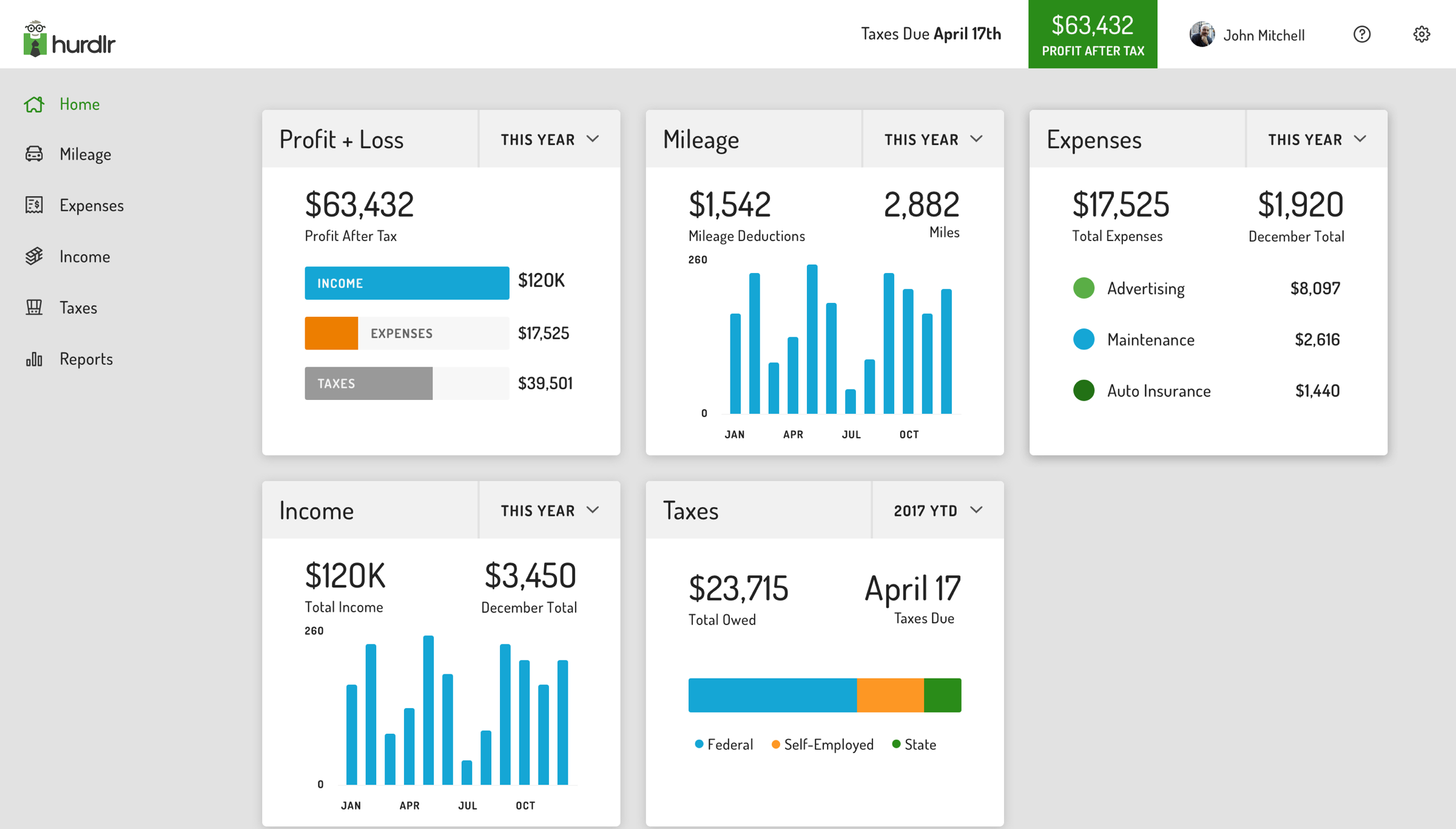

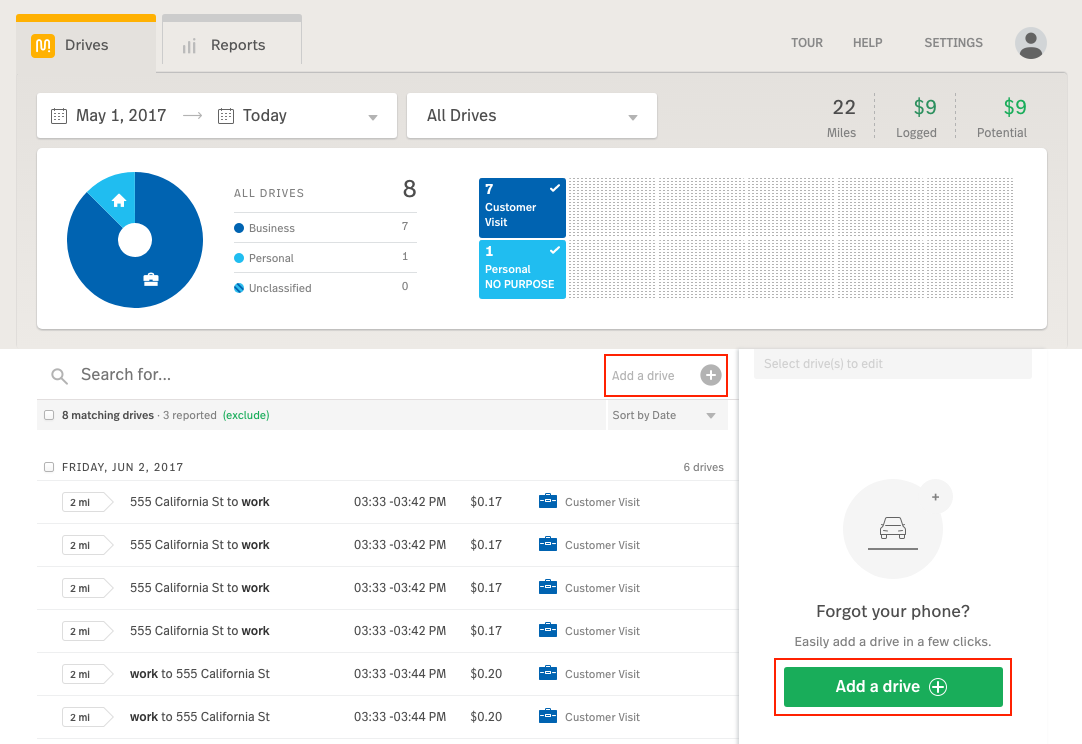

This app provides accurate, automatic mileage. Triplog is a mileage tracker app that helps managers make the expense reimbursement process much smoother. The right way to keep commercial mileage records.

If the car is used for both personal and business purposes, you need to calculate the percentage of business miles and multiply it by the. Ad fleet tracking systems from $99. Start with the mileage logs you have.

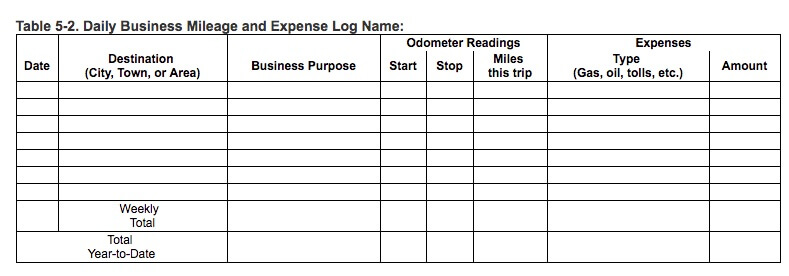

When you are planning to drive for business, document the date, starting point, ending destination,. The templates help you track the number of miles your vehicle has traveled in a. The irs requires that you have accurate and timely records.

However, if you decide to manually track mileage, just make sure to write down 4. The date, your odometer reading at the start and finish of. But instead of extinguishing economic and financial fires, according to many big investors, those steady and.

Ad mark your business expenses as billable & pull them onto an invoice for your client. To prove all these expenses, you need receipts. This implies that you need to keep a daily log to show miles covered, endpoint.

When you track your miles during business travel, your tax savings increase in sync with your odometer. The first option to track miles for taxes is with a mileage log template. The irs is very direct about this and doesn't care for estimates.

Using mileagewise, the same task is only 7 minutes/month. You will need four pieces of information for every business trip: The most significant thing to remember is that you must be able to prove that you recorded the.