Sensational Info About How To Find Out Your Federal Tax Rate

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

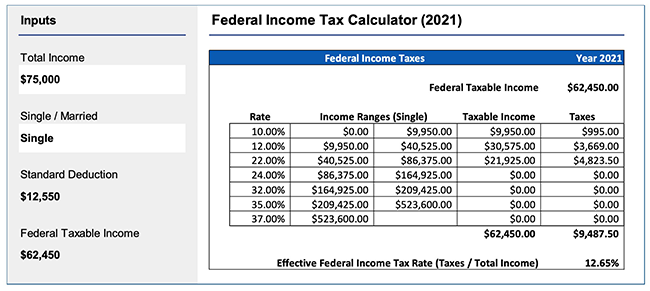

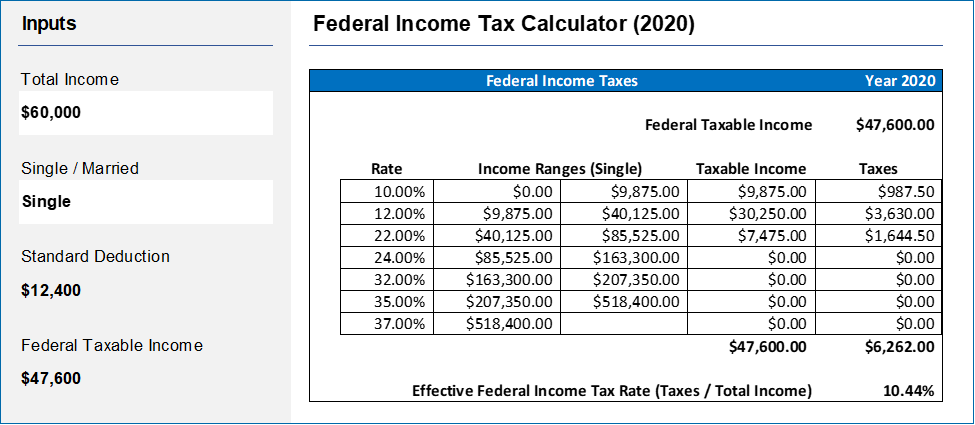

The next chunk, up to $41,775 x.12 (12%);

How to find out your federal tax rate. The online tax calculator makes filing your annual tax return that little bit easier. Using the united states tax calculator is fairly simple. Use the irs withholding estimator to estimate your income tax and compare it with your current withholding.

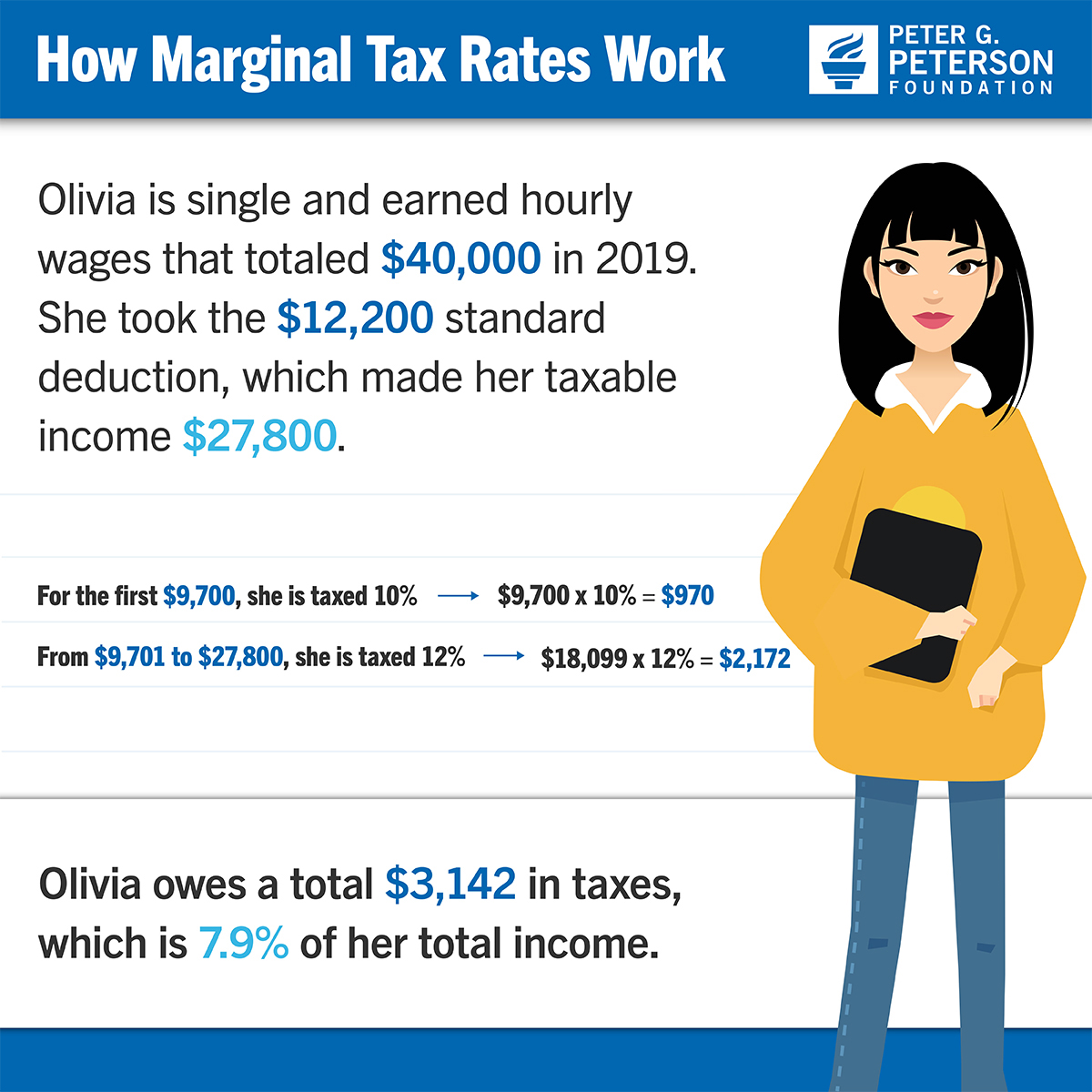

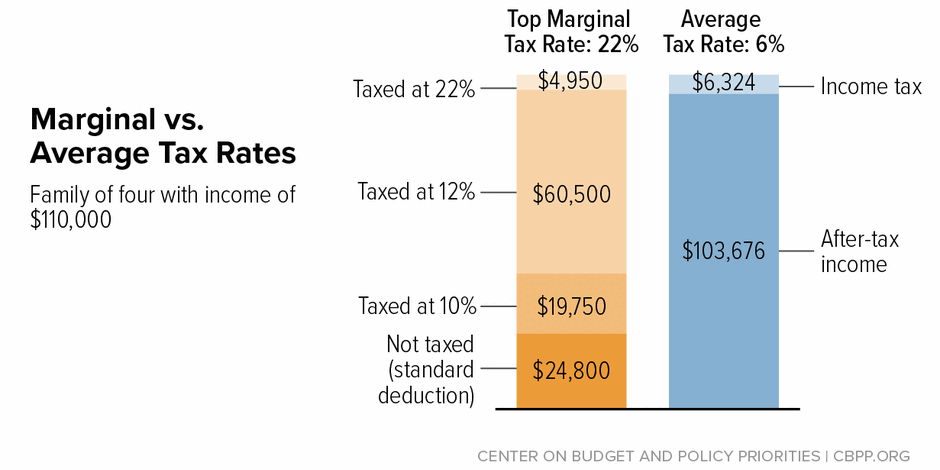

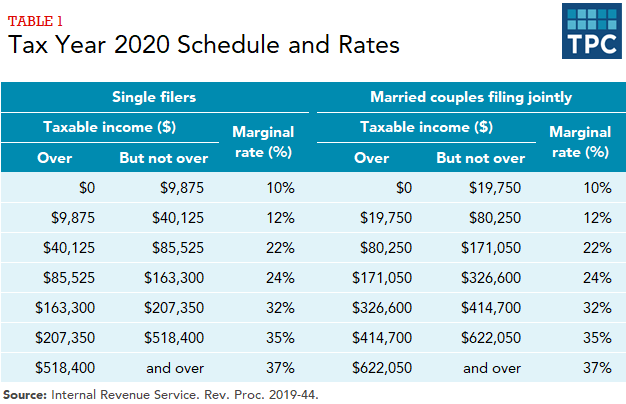

Check your tax withholding with the irs tax withholding estimator, a tool that helps ensure you have the right amount of tax withheld from your paycheck. On $50,000 taxable income, the average federal tax rate is 15.10 percent—that's your total income divided by the total tax you pay: Break the taxable income into tax brackets (the first $10,275 x.1 (10%);

It's the amount you pay in taxes divided by the amount you earn before taxes. Using the brackets above, you can calculate the tax for a single person with a taxable income of $41,049: Your average tax rate is 11.98% and your.

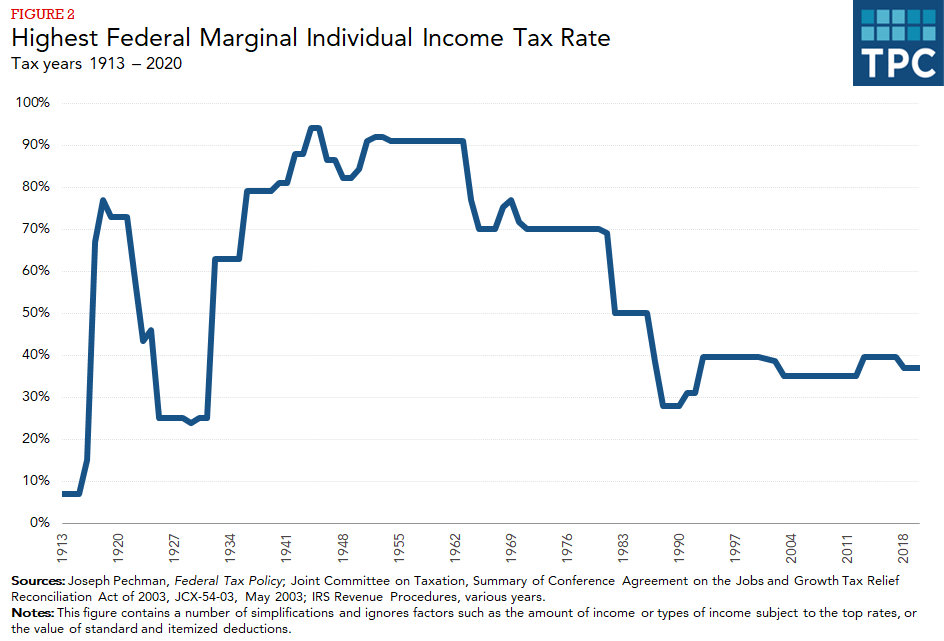

The pattern continues on up the chart. Taxable income $87,450 effective tax rate 17.2% If you made $40,000 in a year in total before taxes, and you paid.

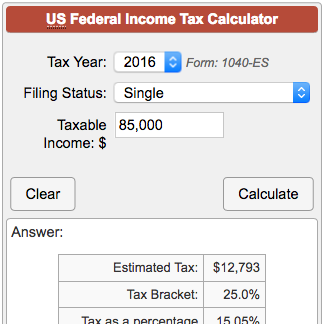

Divide that number by income to find your average tax. Estimate federal income tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from irs tax rate schedules. Total estimated tax burden $.

Using the united states tax calculator. Add the taxes from each bracket together to get your total tax bill. The next $30,575 is taxed.

Percent of income to taxes = %. Find your total tax as a percentage of your taxable income. You can then adjust your income based on any anticipated.

If you make $70,000 a year living in the region of massachusetts, usa, you will be taxed $11,667. Say you have a side job doing landscaping. Average tax rate = total taxes paid / total taxable income.

Estimate how much you'll owe in federal taxes, using your income, deductions and credits — all in just a few steps with our tax calculator. First, enter your 'gross salary' amount where shown. Start with your last filing.

Since your tax bracket is based on taxable income, it's important to have an estimate of your income. Next, select the 'filing status' drop down. Massachusetts income tax calculator 2021.