Can’t-Miss Takeaways Of Info About How To Build Credit In Canada

Financial programs can help build your credit history by allowing you to create and pay to a secured account reported to canada’s credit reporting agencies and added to your credit.

How to build credit in canada. If you want to know how to rebuild your credit, here are five steps you can start taking. Steps to business credit building. To find the best option, ask your local bank what packages they offer for globally minded citizens.

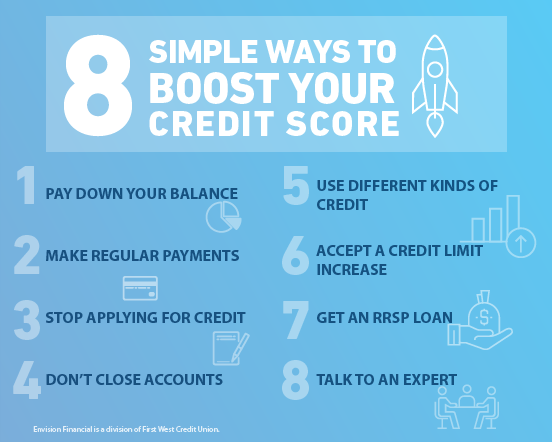

8 ways to increase your credit score 1. It is important here to build a. Bank accounts that allow you to apply for mortgages to purchase property in.

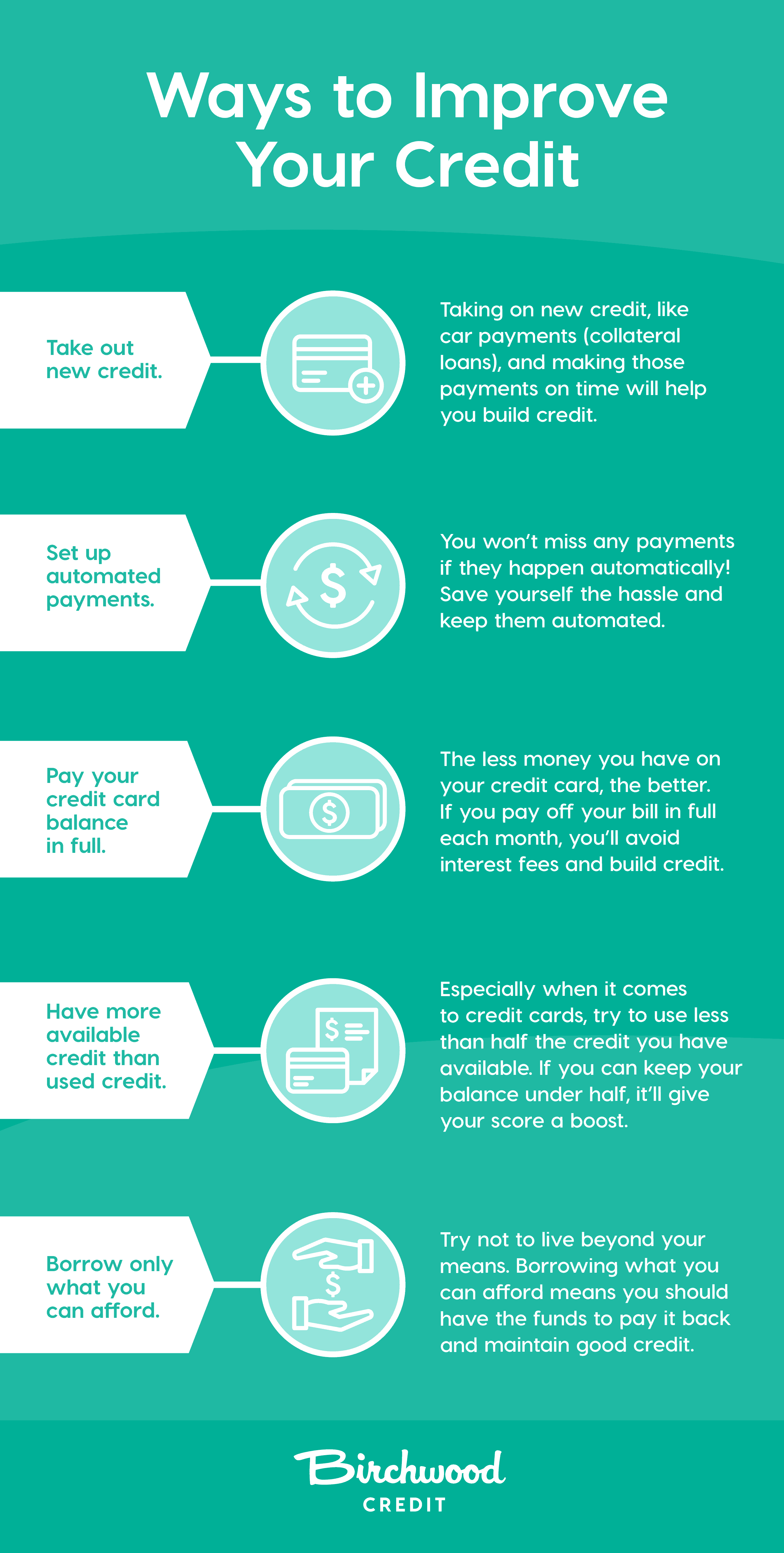

A variety of credit products—a credit card, a car loan and/or a line of credit—may improve your credit score, if you can pay back any money you borrow, of course. Rbc is one of the largest banks in. There are a few things you can do to start building your credit in canada.

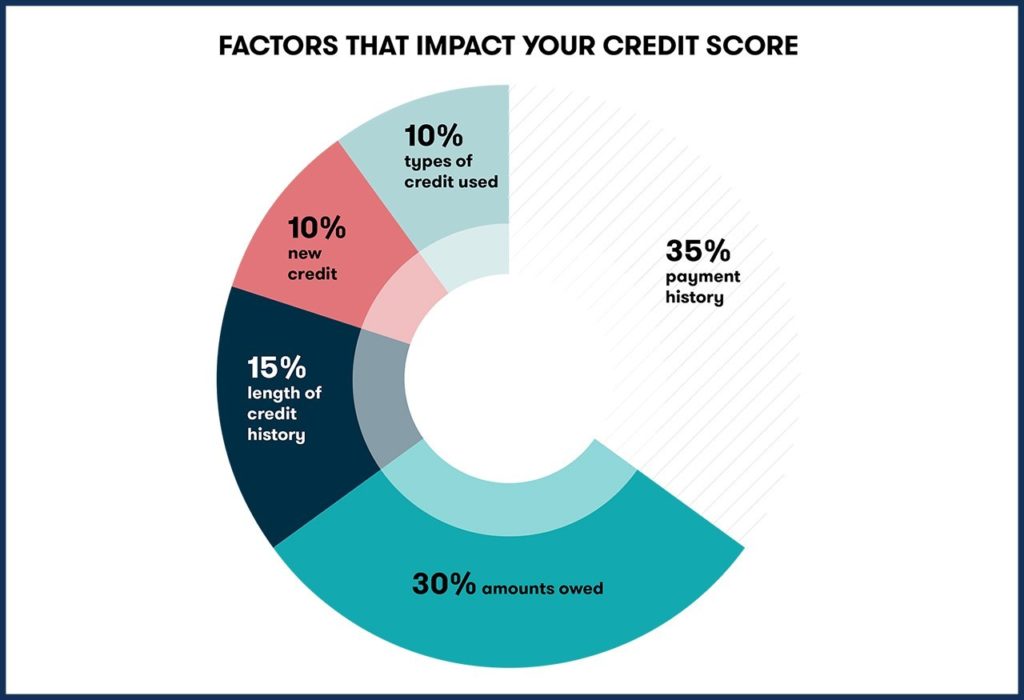

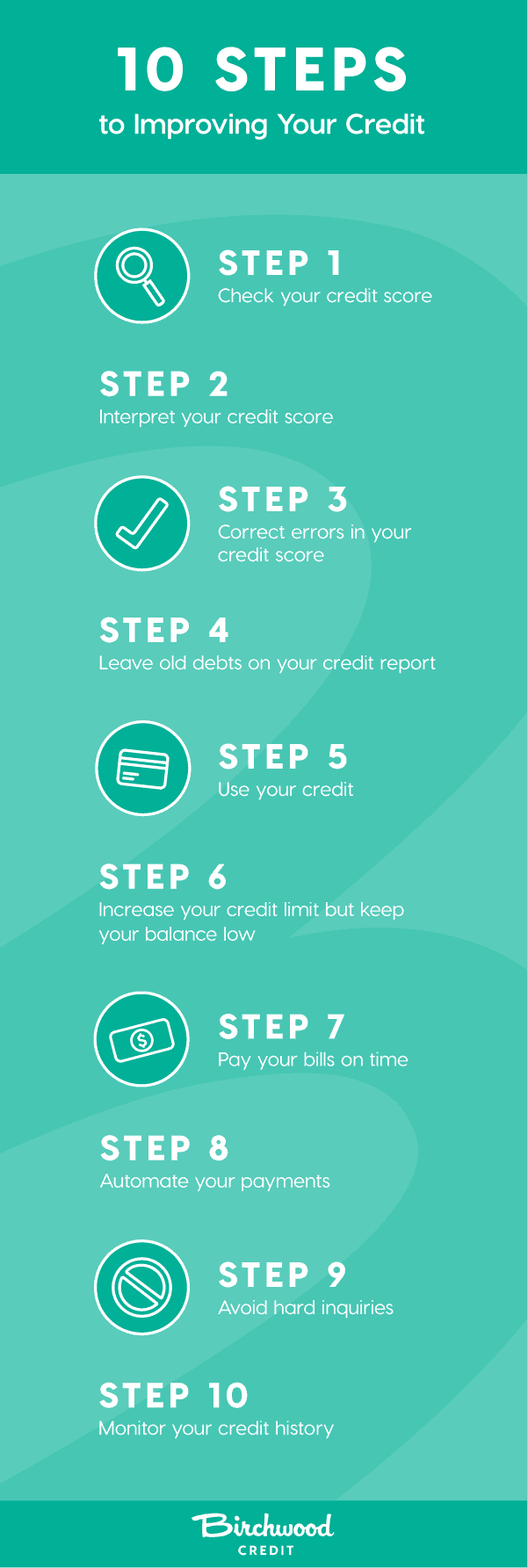

Keep a low balance 4. Inspect your credit report and score 2. These programs offer debt relief.

To help boost your credit score, one of the best things you can do is to manage your spending. Lendle secured credit card perks. Another is to take out a.

Using a credit card is one of the easiest ways to build credit in canada as a newcomer. Another option is to apply for a retail credit card. One is to get a secured credit card, which is backed by a deposit you make with the issuer.

Having good business credit is key in helping you grow your business, getting access to capital and having strong relationships with suppliers. Since your credit score is 0 it is tough for the person to access your capabilities. Overspending will cause you to turn to credit cards.

A retail credit card is similar to a traditional credit card, except it’s offered by your favourite retailer. Having a canadian credit card and making regular payments on it is the easiest way to establish a credit history and build a good credit score in canada, which can help you qualify for other. The trickiest one is when it is your first time applying for a loan or credit card.

So, once you’ve chosen the right business entity, you must now identify the structure of your business. When you use a credit card and pay off your balance, the credit card company. The lendle secured credit card is a unique card that offers a number of benefits from cash back to better credit.

Check your credit report the first step in repairing your credit is determining which areas need. Pay your bills on time 3. Most of the large banks in canada offer free credit scores to their customers.