Inspirating Info About How To Become A Minnesota Resident

“domicile” is the place you intend to make your home permanently or for an indefinite period of time.

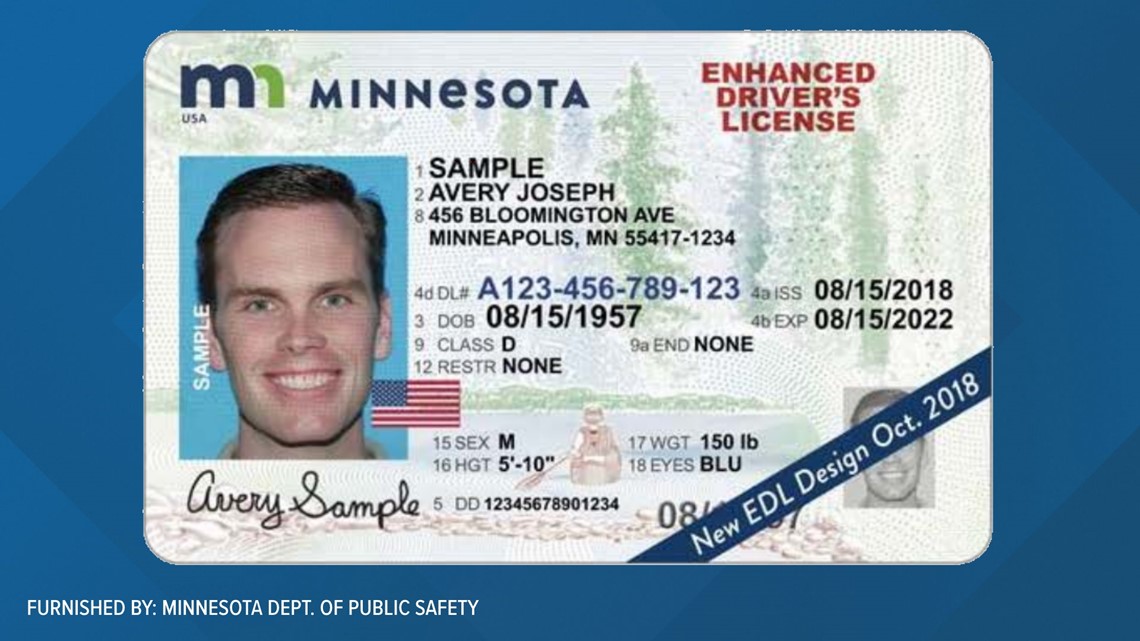

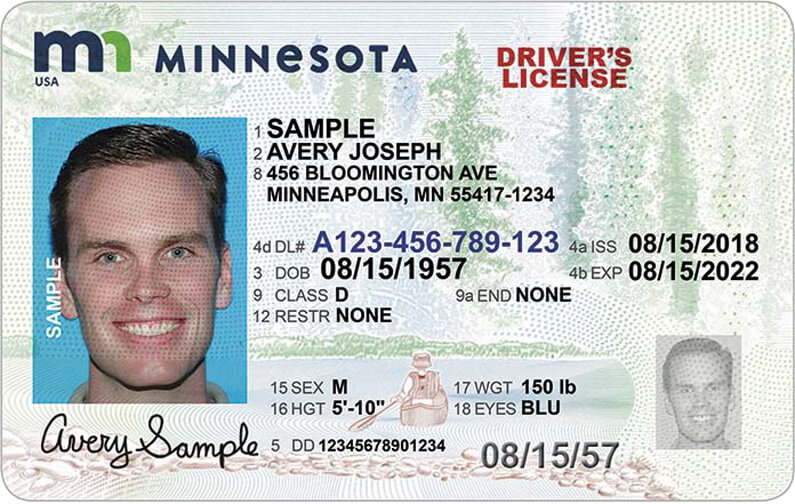

How to become a minnesota resident. As you establish minnesota residency, you'll need to complete a number of tasks with the mn driver and vehicle services division. You or your spouse rent, own, maintain, or occupy an abode. If you are a u.s.

Any part of a day counts as a full day. Fill out a license reinstatement application and pay an $18.50*. Residency refers to the location of your permanent residence.

Not sure where this is coming from. One primary and one secondary identification document (see. Must be eligible to vote in minnesota.

As a new minnesota resident you must present: You spend at least 183 days in minnesota during the year. To restore your driving privileges, you must:

Current employment or intent to remain in minnesota are not requirements for these people, and they can establish state residence even if they maintain a home in another. Any part of a day counts as a full day. Any person becoming a resident is required to.

You spend at least 183 days in minnesota during the year. When i moved back to mn from il (after 10 years) in 2012, i didn't have to do this at all. Your minnesota residency status can be one of these:

To get a south dakota driver’s license, you can visit any dmv in the state. You are considered a minnesota resident for tax purposes if both apply: Any part of a day counts as a full day.

Working and attending school in minnesota on a foreign. A resident of another state attending school in minnesota. Once you establish your domicile in.

Citizen or permanent resident (green card), you are considered a minnesota resident if: Step #4 visit the dmv. You are considered a minnesota resident for tax purposes if both apply:

If you're present in minnesota for more than 183 days over the course of a year and maintain a living place—an abode—which is a place with living quarters,. You spend at least 183 days in minnesota during the year. Must have not filed for another office at the upcoming primary or general election.