Beautiful Work Info About How To Apply For A Government Small Business Loan

If you even qualify for one, it would have to be in a redevelopment area, like the ward.

How to apply for a government small business loan. The veterans small business enhancement act is a law that was created to help veterans start and grow their businesses. First, the good news is that most loans won’t substantially impact the taxes you owe. Apply for up to $2m.

Start the questionnaire to find the right loans for you. Take your time preparing these documents and make sure you fill them out. The paycheck protection program (ppp) ended on may 31, 2021.

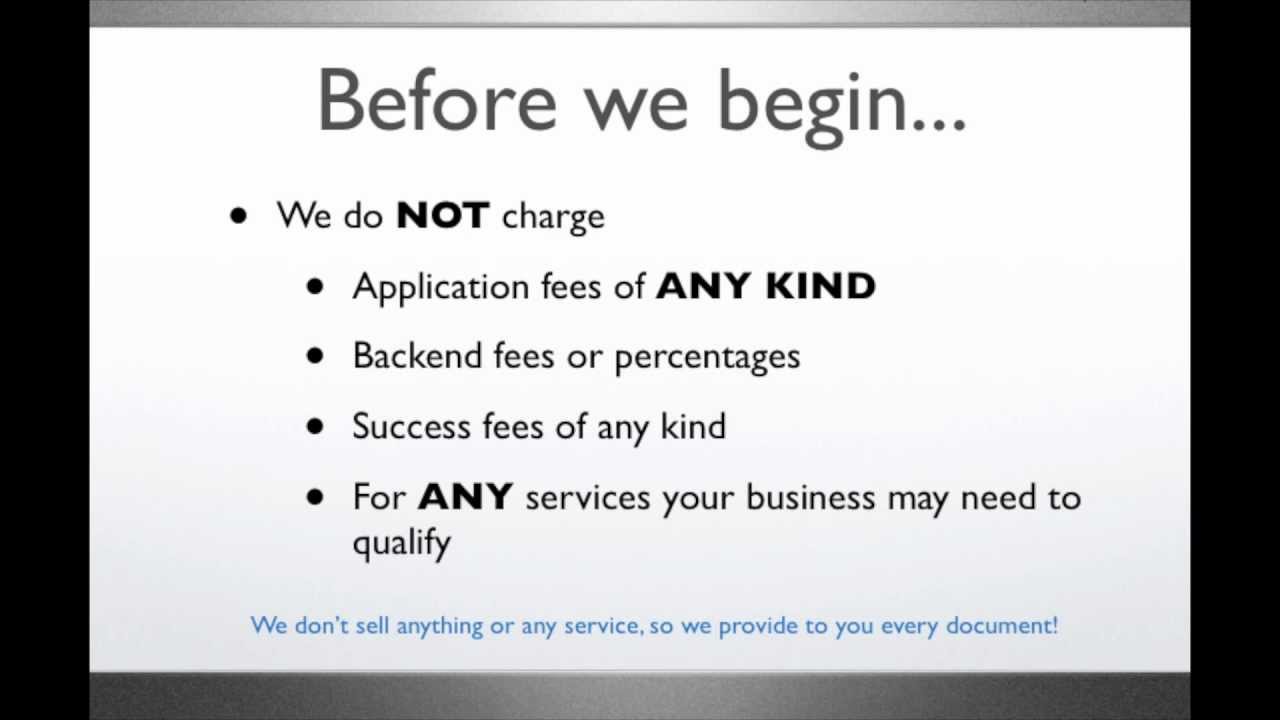

Use the federal government’s free, official website, govloans.gov, rather than commercial sites that may charge a fee for. Apply for up to $2m. Ad 10 best business loans of 2022.

Start loan finder what is govloans.gov? Receiving a lump sum of cash in the form. How to get a government loan for small businesses:

These are the basic requirements when applying for a small business loan in the philippines. Now that you have determined what your business needs to qualify for a loan, the next step in learning how to apply for a business loan is to identify. Business loans in citrus heights, california are a fast and easy to get the cash you need to run your business.

Get a business loan from the top 7 online lenders. Meet with your banker the sba. To apply for the loan all of the following must apply:

How to apply for a government small business loan applying for a government loan is remarkably similar to applying for any other loan. Traditional bank business loans are sought after by small enterprises because of the inbuilt safety nets. Here are the results i came up with:

Govloans.gov is an online resource to. The veterans small business enhancement act. If you follow the guidelines, your loan.

Before you apply for a business loan, there are things you can do to improve your chance of success. We support america's small businesses. Applying for a business loan is easier than ever.

Sba 7 (a) business loans and tax deductions. Small business grants are far and few between. List down your business’s needs;

/168450140-56a0a4af3df78cafdaa38ba4.jpg)